The Clean Energy Boom: Clean Energy Jobs are Growing, but Will They Stay?

Despite $126 Billion in domestic investment and over 142,000 jobs created in 2023, the clean energy industry's progress could be undone by the November election.

The U.S. Energy and Employment Report (USEER) is out. The report is a bright beacon for the energy industry and casts a heavy shadow on the fumbling U.S. economy which has weathered massive tech layoffs by the highest valued companies including Microsoft, Apple, and Google. Energy sector jobs grew by 250,000 in 2023, and 56% of those jobs were in clean energy. The national job creation rate was 2%, but clean energy jobs were double that rate, increasing at 4.2% totaling over a 140,000 new positions. Clean energy was booming while 260,000 tech workers were laid off across 1,200 tech companies1. Of course, this is no surprise given that the White House was estimated to have spent $34 Billion in 2023 on clean energy and transportation programs, according to the Rhodium Group at MIT2.

As proponents for addressing climate change revel with Keynesian economists, fiscal conservatives are having fits about inflation, the national debt and Biden’s budget. The conservative group American’s for Prosperity has even made a whole website to voice their complaints at www.bidenomics.com. Talk about living in someone’s head rent free.

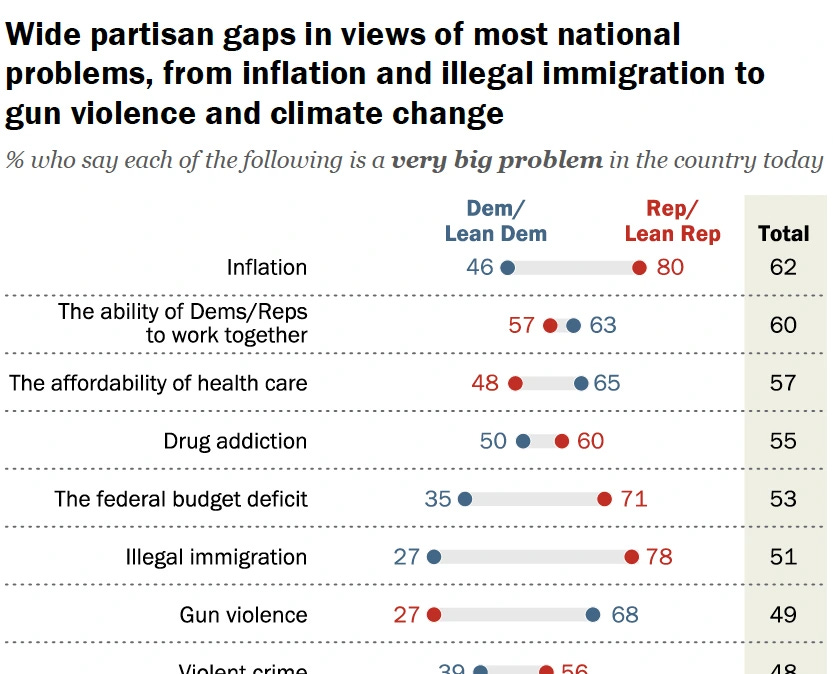

With the 2024 election approaching there should be serious concern by the energy sector that the stream of cash for clean energy could be cut off if the Trump party gains the White House. The good times for clean energy workers may not be shared with the rest of the country and the American public may be opposed to the continued spending with 65% of those polled by the Pew Research Center stating that inflation is their number one concern. Of those polled, 46% of democrats had the same opinion about inflation3 showing the negative outlook is bipartisan.

If the number one issue facing Americans is inflation, which leads to higher prices and a lower quality of life for each dollar spent, then the average American may not have such a rosy perspective of the economy. In previous elections, the economy has been the grim reaper of single term presidents such as the George H. W. Bush and Jimmy Carter. After bowing out, Biden will avoid being another president to fall victim to the economic reaper, but it’s fair to imagine Harris as Biden’s second term by proxy.

Federal spending and ever growing national debt are not being looked at lightly by debt rating entities. Last November, Moody’s changed their own outlook on the U.S. rating to “negative” considering its ever growing financial obligation could reduce the rating to AA4.

However, it wasn’t just the debt and financial obligation that lead to a declining outlook. In the 2023 rating action, Moody’s highlighted in all caps in their report: “FISCAL RISKS ARE EXACERBATED BY ENTRENCHED POLITICAL POLARIZATION UNDERSCORING RISING POLITICAL RISK.”

As the Inflation Reduction Act concludes it’s second year, rating agencies, the general public and clean energy are all looking to November to see what to expect for the next four years. If Trump is elected, he will probably act as expected by Moody’s and make the hard policy redirection causing market turmoil. Unlike Reagan taking Carter’s solar panel installation off the White House roof after his election, Trump’s actions would likely be more tangible than symbolic considering his rhetoric:

“You can be loyal to American labor. You can be loyal to the environmental lunatics. But you really can’t be loyal to both. It’s one or the other,”

It’s an unfortunate perspective to have considering that in 2023 there was $126 billion of domestic industrial investment in clean energy and transportation fueling the creation of 142,000 jobs. All of which could be undercut by whims of a returning president known for his temperance.

https://www.cnbc.com/2024/03/15/laid-off-techies-struggle-to-find-jobs-with-cuts-at-highest-since-2001.html

https://www.eenews.net/articles/modeling-federal-spending-on-clean-energy-transportation-totaled-34b-in-fiscal-2023/

https://www.pewresearch.org/politics/2024/05/23/publics-positive-economic-ratings-slip-inflation-still-widely-viewed-as-major-problem/

https://www.pgpf.org/blog/2024/01/moodys-lowers-us-credit-rating-to-negative-citing-large-federal-deficits